Tubac, Arizona, is a warm and welcoming town located in the Santa Cruz Valley of southern Arizona. The city is known for its art galleries, golf courses, and stunning natural scenery.

Tubac, Arizona, is a beautiful place to live, and many people are interested in buying properties here. One question that often comes up is whether or not the property taxes are high. Property taxes in Tubac are low compared to other parts of the country, making it a desirable location for homeowners and businesses.

So if you’re thinking about making Tubac your home, don’t let the property tax scare you away – it’s something you can easily manage on a fixed income. In this blog post, we’ll look at the facts about property taxes in Tubac.

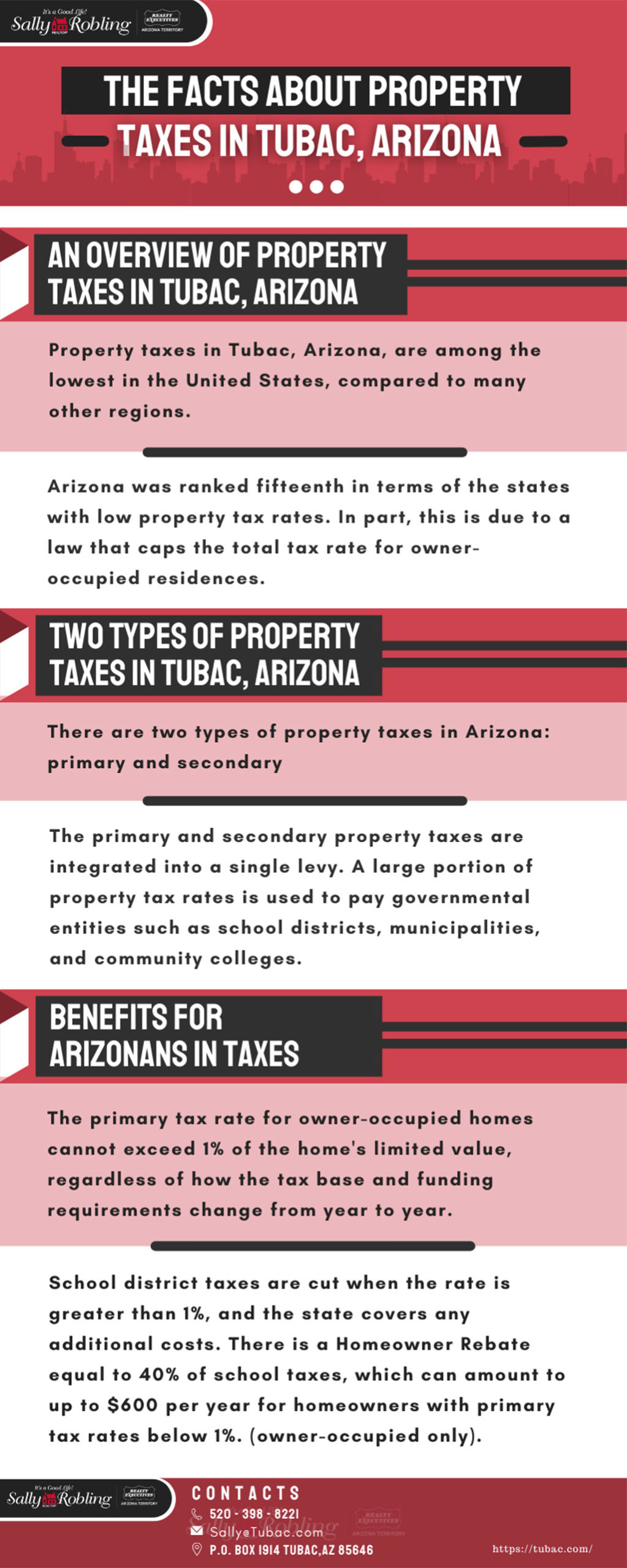

An Overview of Property Taxes in Tubac, Arizona

- Property taxes in Tubac, Arizona, are among the lowest in the United States, compared to many other regions.

- In 2018, Arizona had an average tax rate of 0.77%, which was significantly lower than the national average of 1.21%, according to SmartAsset’s calculations.

- Arizona was ranked fifteenth in the states with low property tax rates. It is due to a law that caps the total tax rate for owner-occupied residences.

- For retirees, Arizona is a tax-friendly state. Social Security benefits are exempt from taxation, as are up to $2,500 in other public pension benefits (such as those from the military, civil service, and the state of Arizona).

- Private pension plans and out-of-state annuities are exempt from the alternative minimum tax. Still, all other types of retirement accounts are subject to the standard federal income tax rate, ranging from 2.5% to 4.5%.

- When it comes to property taxes, homeowners who make less than $40,368 per year are eligible for a three-year freeze on their property’s assessment.

- Taxes paid annually as a percentage of median house value in Tubac amount to an effective property tax rate of 0.77%. For example, $3,810 is the annual tax bill for a $495,000 home. There is a 6.6% total sales tax on all purchases.

- In Tubac, Arizona, the average yearly mortgage payment is $1,367, about $800 less than the national average.

- Arizona property taxes on a $700,000 home are average $5,915 per year, but they are $8,477 on a national level for the same residence. Those who own multi-million-dollar homes will save a lot of money with this tax break!

- The Grand Canyon State has a two-tax-year cycle. Homeowners must make two tax payments during a year: one in October and one in March.

Calculation of Real Estate Taxes in Tubac, Arizona

A few details are needed to figure out how much a piece of Tubac, Arizona property owes in property taxes. One of these is the property’s current market value or total cash value (FCV), as determined by the county tax assessor. Comparable homes and nearby home sales are used to determine the entire cash value of the property.

It’s a common misconception that paying property taxes is equivalent to paying them based on the home’s entire market worth. Instead, the assessed or limited property value is used to determine real estate taxes (LPV). An individual LPV is computed using a statutory formula and was put in place to lessen the impact of inflation on property taxes.

It’s illegal for the LPV to surpass the home’s cash worth, and it’s usually lower than the FCV. By law. Limits on how much each year can rise (currently 5% maximum) keep significant tax spikes from occurring when property values rise quickly.

The county tax assessor first calculates the LPV and then uses an assessment ratio to determine a property’s assessed value. 10% is the assessment rate for residential properties.

This means that depending on the property’s LPV, the assessed value will not exceed 10% of the property’s FCV. Let’s imagine you buy a home in Tubac County, Arizona, with a total cash value of $550,000. You would be taxed on the $40k assessed value of your property.

Two Types of Property Taxes in Tubac, Arizona

The primary tax rate for owner-occupied homes cannot exceed 1% of the home’s limited value, regardless of how the tax base and funding requirements change from year to year.

School district taxes are cut when the rate is greater than 1%, and the state covers any additional costs. There is a Homeowner Rebate equal to 40% of school taxes, which can amount to up to $600 per year for homeowners with primary tax rates below 1%. (owner-occupied only).

However, no tax advantages are available for second houses, vacation homes, or rental properties. For more information on these tax breaks, speak with a tax professional.

What the Statistics Mean for Arizona Homebuyers

When house prices rise, the tax cap helps keep taxes stable and predictable year after year for families, retirees, and high-end homeowners alike. Retirees will find Tubac, Arizona’s low tax rates and other benefits, such as no tax on social security and tax deduction eligibility for those receiving a pension, to be economically advantageous.

Final Thoughts

Tubac, Arizona, is a great place to call home. The people are friendly and welcoming, but the property taxes are also very reasonable.

An experienced realtor in Arizona can help you through the process of finding and purchasing a luxury house in Tubac, as well as give you all the information you need to make a well-informed decision.

For those of you who are considering buying a home in this beautiful town, our team would be honored to help you find the perfect place. Contact us today and enjoy a personalized buying experience – we can’t wait to welcome you to our community!